Get This Report about Amur Capital Management Corporation

Get This Report about Amur Capital Management Corporation

Blog Article

Amur Capital Management Corporation for Dummies

Table of ContentsAmur Capital Management Corporation Can Be Fun For AnyoneThe Basic Principles Of Amur Capital Management Corporation Amur Capital Management Corporation - An OverviewAll about Amur Capital Management CorporationUnknown Facts About Amur Capital Management CorporationNot known Details About Amur Capital Management Corporation The 15-Second Trick For Amur Capital Management Corporation

A low P/E ratio may suggest that a firm is undervalued, or that investors anticipate the business to encounter extra tough times in advance. Capitalists can use the typical P/E ratio of various other firms in the very same market to develop a baseline.

Some Known Questions About Amur Capital Management Corporation.

The average in the vehicle and vehicle sector is just 15. A stock's P/E ratio is easy to find on many financial coverage internet sites. This number suggests the volatility of a supply in contrast to the marketplace in its entirety. A protection with a beta of 1 will certainly display volatility that's identical to that of the market.

A stock with a beta of above 1 is theoretically more volatile than the marketplace. A protection with a beta of 1.3 is 30% more unpredictable than the market. If the S&P 500 increases 5%, a supply with a beta of 1. https://www.nulled.to/user/6135857-amurcapitalmc.3 can be anticipated to climb by 8%

Amur Capital Management Corporation Fundamentals Explained

EPS is a buck figure standing for the portion of a business's incomes, after tax obligations and participating preferred stock dividends, that is designated to every share of ordinary shares. Capitalists can use this number to evaluate exactly how well a business can deliver worth to investors. A greater EPS begets greater share rates.

If a firm regularly stops working to deliver on incomes forecasts, a capitalist might intend to reconsider acquiring the stock - best investments in copyright. The calculation is easy. If a company has an earnings of $40 million and pays $4 million in rewards, then the staying sum of $36 million is divided by the number of shares impressive

Amur Capital Management Corporation Can Be Fun For Everyone

Financiers often get interested in a supply after reviewing headlines about its phenomenal performance. Just keep in mind, that's the other day's information. Or, as the spending brochures constantly see here phrase it, "Previous efficiency is not a predictor of future returns." Sound investing choices ought to think about context. An appearance at the fad in costs over the previous 52 weeks at the least is needed to obtain a sense of where a supply's rate might go next.

Let's consider what these terms suggest, just how they differ and which one is ideal for the average financier. Technical analysts comb through substantial volumes of information in an effort to forecast the instructions of supply costs. The data consists primarily of previous pricing information and trading volume. Basic analysis fits the needs of a lot of capitalists and has the advantage of making good sense in the real life.

They think rates comply with a pattern, and if they can understand the pattern they can take advantage of it with well-timed trades. In recent decades, modern technology has actually allowed more investors to exercise this design of spending due to the fact that the devices and the information are much more obtainable than ever. Basic analysts consider the intrinsic value of a stock.

Some Known Details About Amur Capital Management Corporation

Technical evaluation is ideal matched to a person that has the time and comfort degree with data to place unlimited numbers to make use of. Over a duration of 20 years, yearly charges of 0.50% on a $100,000 investment will certainly decrease the portfolio's value by $10,000. Over the very same duration, a 1% fee will lower the exact same portfolio by $30,000.

The fad is with you (https://ca.enrollbusiness.com/BusinessProfile/6689516/Amur%20Capital%20Management%20Corporation). Take advantage of the fad and shop around for the lowest cost.

Top Guidelines Of Amur Capital Management Corporation

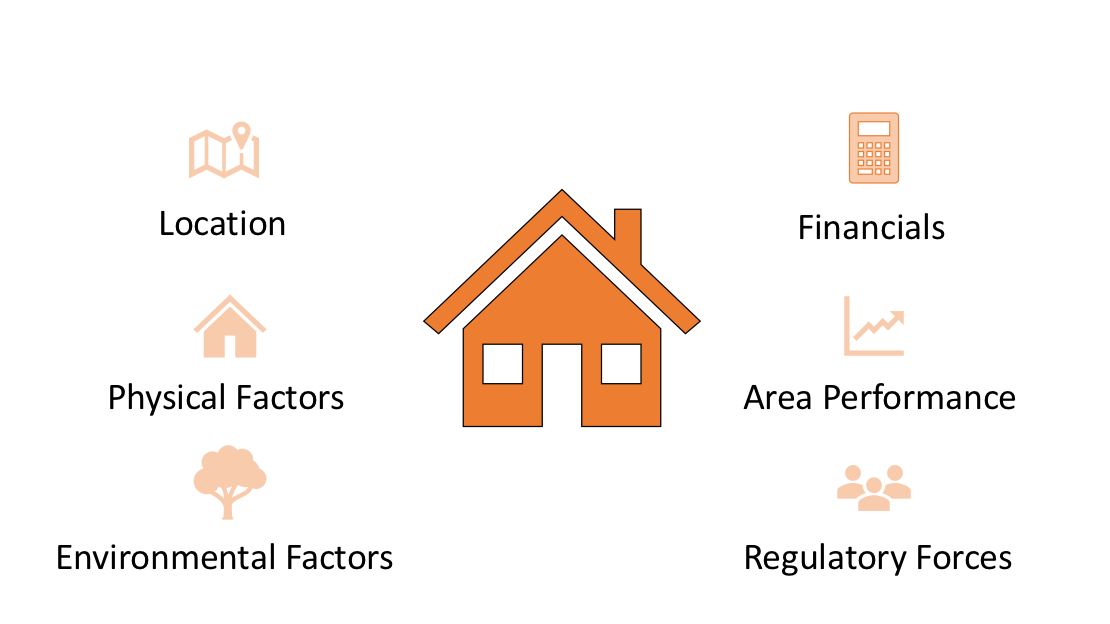

Closeness to amenities, eco-friendly room, panoramas, and the area's condition aspect plainly into household home assessments. Nearness to markets, warehouses, transportation centers, highways, and tax-exempt locations play a vital duty in business residential or commercial property evaluations. A crucial when considering building location is the mid-to-long-term view regarding just how the location is expected to evolve over the financial investment duration.

Amur Capital Management Corporation Things To Know Before You Get This

Thoroughly review the ownership and desired usage of the instant areas where you plan to spend. One way to collect information about the prospects of the area of the residential property you are taking into consideration is to get in touch with the community hall or various other public companies in cost of zoning and city preparation.

This provides regular income and long-term worth admiration. This is normally for fast, tiny to tool profitthe normal property is under building and marketed at a revenue on completion.

Report this page